Ready sites can set cities apart for industrial development

By KATE COIL

TT&C Assistant Editor

As Blue Oval suppliers and other industries look to open facilities in Tennessee, there are several steps municipalities can take to ensure local industrial sites are ready for business.

Jonathan Gemmen is the senior director with Austin Consulting, the firm that provides the consulting work for the Select TN Certification Program as well as the state’s Property Evaluation and Site Development Grant programs. Since 2015, the company has reviewed more than 200 sites in 60 counties for TNECD and seen the certification of more than 70 sites under the Select TN program.

At a recent Blue Oval Community Impact meeting, Gemmen detailed ways cities can ensure their sites are ready to meet the needs of industry and manufacturing, giving them a competitive edge over others.

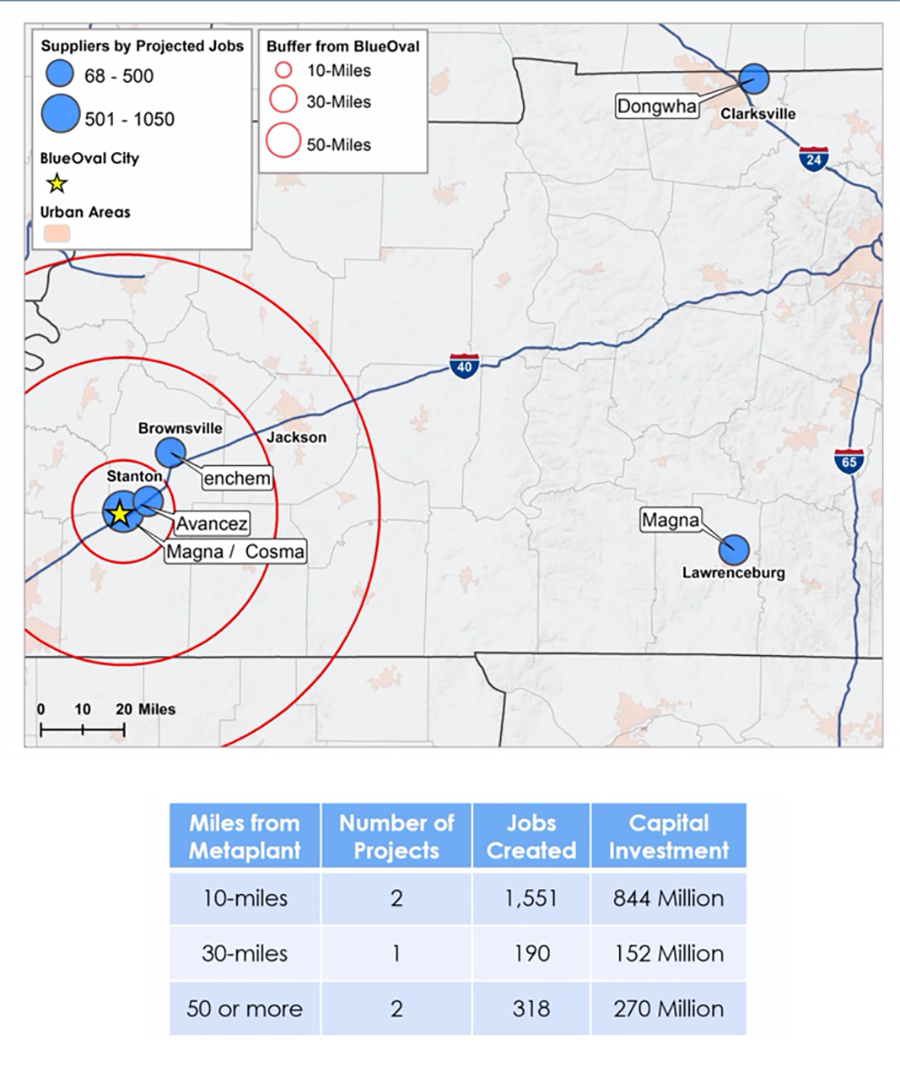

While Blue Oval is located in Stanton, Gemmen said that the supplier chain may reach further out into Tennessee than even the 50-mile radius around the plant, especially as suppliers have already landed in Clarksville and Lawrenceburg. Additionally, the flood-prone land around the Mississippi River in Arkansas means Tennessee’s higher ground is a safer bet.

Gemmen noted many communities have already done much of the preliminary work they need to prepare for industrial development, such as taking advantage of state-sponsored development programs. He advocated for communities to continue having strategic discussions around smart growth and revisiting past property evaluation reports for ideas as well as how to move forward with infrastructure and community improvements.

Often, a company’s locations strategy focuses on transportation, available sites, utilities cost, freight costs, sustainability, and if there is room for expansion. When it comes to specific sites, they will look at labor market analysis, property evaluations, infrastructure, availability of sites and buildings and operating costs such as real estate, labor, transportation, utilities, and taxes.

Once they have narrowed down their top regions or sites, the company will then look into deep dive evaluations on topics like site feasibility, zoning, pre-development approvals, permitting, environmental and geotechnical surveys, and other studies.

Some of the most critical operation conditions determined by location include labor market sustainability, customer and supplier proximity, utility availability, government support, business climate, and regulatory environment.

Gemmen said companies will be more willing to compromise on some cost-savings versus others. Studies have shown that companies are less likely to want cost variance for workforce but are more willing to see variance in costs for freight and electric power.

“If the labor market is not there, it’s an ongoing headache for usually many plant managers,” he said. “You get a lot of turnover when a bad decision is made location-wise for labor. If you have to, on the financial side, you will bite the bullet and spend $2,000 an acre on real estate. A Fortune 500 Company that can honestly afford it, they are going to do it if they know they are in a sustainable labor market where there won’t be issues.”

Gemmen said there is a misconception that incentives help land projects, when really an incentive can serve as a “tie-breaker” putting one site above another if both are equally suited.

“The one thing that is essentially 100% in your control is having a good site and preparing to get utilities there,” he said.

Companies will also look for different things in an undeveloped site than they would an existing structure or spec building. Winning sites are flat and cleared of major vegetation, have utilities on site with sufficient capacity, have transportation access (road/rail), suitable soil drainage, zoning suitable for use, compatible neighbors, free of contamination if previously used, environmental documentation, and a willing seller at a competitive price.

For a site with an existing building, Gemmen said the focus is often on the layout or design of the building, if the building has multi-functional space and is in functional condition, there is room for circulation of trucks at docks, there are separate entrances for employees and truck traffic, and includes a clear height of at least 28 feet, environmental documentation, and a competitive asking or lease price.

"I was at the airport in McKenzie in 2015 where they had a bunch of existing buildings, mostly empty,” he said. “There were mostly storage buildings and had all closed down about 15 years before. It was really tough to see. When you have existing buildings, it can be easy come, easy go. They can shut down. But when someone needs to get up and running quickly and need a building, you can meet that need. I went back to McKenzie just before the pandemic and all those buildings were full. They were older buildings, but when you need to be up-and-running as a supplier it’s a real advantage to have a building.”

One essential factor in a site’s viability - regardless of if there is a spec building or not - is its utility infrastructure, including electricity, water, natural gas, and sewer. Gemmen said competitive rates, reliability and redundancies in ensuring delivery of utilities, and low impact fees can give a competitive advantage to communities.

Unreliable utilities, such as electric grids damaged by weather events or water resources known for going dry, can mean higher production costs.

"You may have a substation right next to the site, but is the transmission line that services that substation resistant to straight line winds?” Gemmen said. “It’s not just about utility cost; it’s about do you have the distribution voltage, how much capacity is at the substation, and how much capacity is in the line by the site. Time is money when an operation is down and you have employees who are going to get paid either way. Electric shut down due to loss of power can cost tens of thousands of dollars per hour in lost revenue.”