State Funding Board approves conservative budget projections; growth still expected

By KATE COIL

TT&C Assistant Editor

While policy changes have led to a decline in revenue, Tennessee’s state budget is expected to rebound amid positive economic growth.

The four present members State Funding Board – Comptroller of the Treasury Jason Mumpower, Secretary of State Tre Hargett, State Treasurer David Lillard, and Finance and Administration Commissioner Jim Bryson – unanimously approved a conservative revenue estimate for Fiscal Years 2025 and 2026.

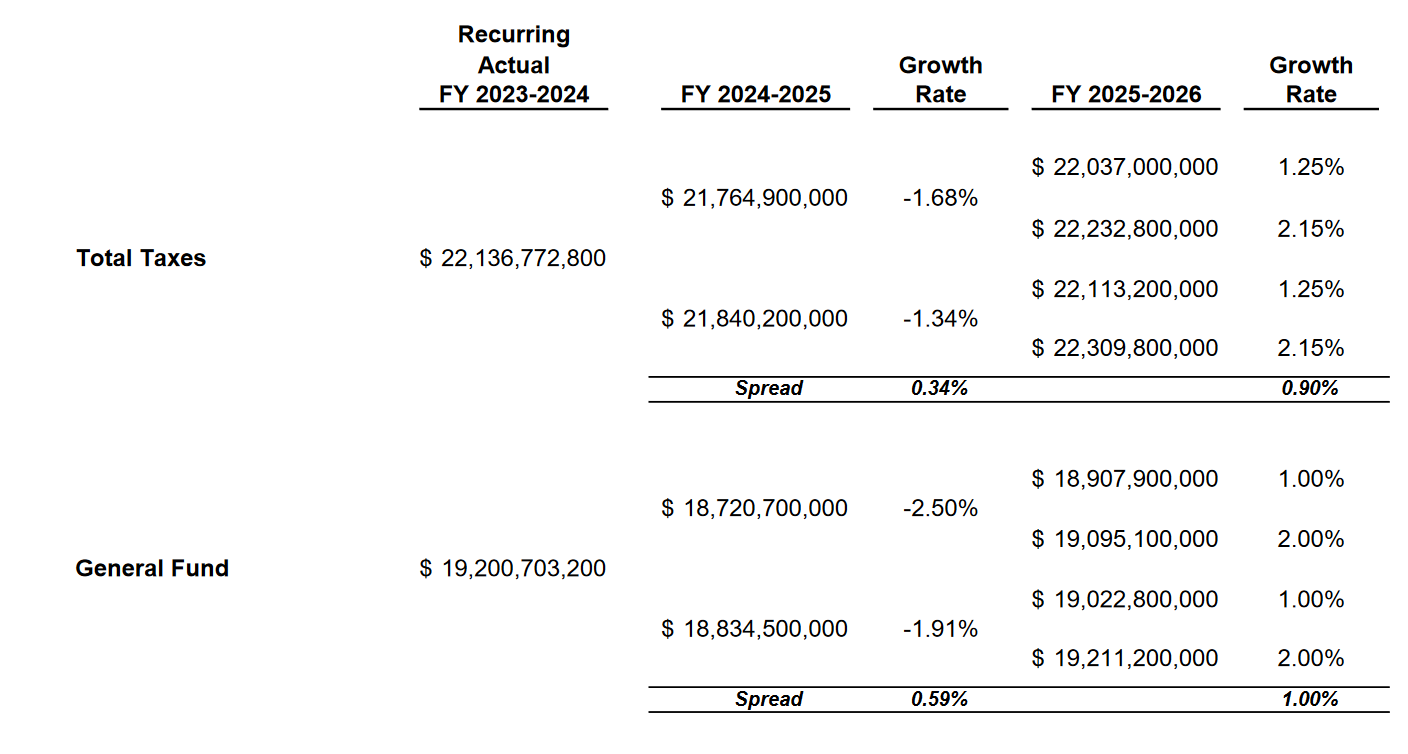

The projected FY24-25 budget will range from $21.76 billion on the low end to $21.84 on the high end with a general fund of between $18.72 billion on the low end to $18.83 on the high end. Depending on the outcomes of the FY24-25 budget, projections for the FY25-26 budget could range as low as $22.037 billion on the low end to $22.309 billion on the high end with a general fund of $18.907 on the low end and $19.211 on the high end.

Finance and Administrator Director of Budget David Thurman said staff recommended the following:

- A range of -1.68% and -1.34% for total taxes in FY25

- A range of -2.5% to -1.91% for general fund taxes in FY25

- A range of 1.25% to 2.15% for total taxes in FY26

- A range of 1% to 2% for general fund taxes in FY26

The state funding board projections are based on reports given previously by two of the state’s top economists - Dr. Don Bruce, professor of economics and director of the Boyd Center for Business and Economic Research at the University of Tennessee; Dr. Joseph Newhard, assistant professor of economics at East Tennessee State University - and officials from two state departments: the Tennessee Department of Revenue and Tennessee Fiscal Review Committee.

Despite a strong underlying economy, Thurman said spending patterns are slowing and COVID relief funds are running out. As a result, previously accelerated economic growth is slowing.

He said policy changes have also impacted growth, which accounts for the projections made for FY26. The fact that the state has used recurring funding for non-recurring items means that the state is cushioned against slowing growth.

Thurman also noted that a “normal” growth range is between 3-5%.

Economic leaders told members of the Tennessee State Funding that the state has seen strong growth in sales tax but policy-related drops in franchise and excise collections, predictions that the economy will see a soft-landing for inflation, and uncertain geopolitical concerns may impact the economy.

Bruce is projecting a decrease of -1.2% this upcoming fiscal year due to policy changes and growth 2.7% in the next year, while Newhard predicted a more optimistic forecast with growth of 0.6% for the upcoming fiscal year and 4.54% for the next.

The state Department of Revenue is projecting 1.6% revenue growth this fiscal year and 2.2% next while the Fiscal Review Committee projected 0.79% growth this fiscal year and 3.17% in the next. The new franchise and excise tax policy is estimated to have eliminated 11.54% and 17% from revenue projections. Officials noted that the economic future for the state could prove riskier because of geopolitical situations in Europe and in the Middle East as well as if federal domestic policy changes post-election.

All four groups of economic experts agreed that recent policy changes will lead to a decline in state revenues, that the days of double-digit growth for state revenues are over, and that the state is in an enviable position for unemployment. Population and job growth is expected to slow and there remains a gap in the state’s workforce that may not be filled.

Bruce noted that there is a 64,000 gap in the workforce participation rate, meaning there are many more open positions than people seeking employment. This may be because of factors like a geographic disparity between where these jobs are located and where those seeking employment live as well as factors such as many of those moving into the state doing so for retirement. The workforce participation rate also does not count retirees, full-time students, stay-at-home parents, or those who work gig economy jobs, such as driving for Uber or Lyft.

In his projections, Bruce said the state can expect slow but real growth with Tennessee’s economy projected to do better than the national average. Tennessee's individual per capita income is also rising to meet the national rate. Bruce said the present rate for Tennessee is $62,229 per year while the national average is $69,810.

Newhard expressed concern that housing costs may also be impacting the state’s growth, especially as median home prices in Tennessee were higher than the U.S. average and all adjacent states save Virginia – which is somewhat of an outlier. While listings are beginning to return to pre-pandemic levels, he noted mortgage, rent, and other housing costs are eating into sales tax revenues. Many Tennesseans have taken on debt or taken money out of savings for housing, and owning a home remains one of the best ways to build wealth.

Both the Department of Revenue and Fiscal Review Committee officials noted strong growth in sales tax with policy-related declines of 17% in franchise and excise tax. The Department of revenue has projected 5% growth in sales and use taxes next year and 3% the following year. Sales tax will remain high as prices remain high.

Prices for basic goods are expected to remain high as the U.S. typically does not see deflation of prices once they have inflated. Jeff Bjarke, director of research for the revenue department, noted that there have only been two instances of deflation in the U.S. economy in the past 60 years.