Migration to help Tennessee weather national recession

By KATE COIL

TML Communications Specialist

Recession woes may not be as bad as first feared on the national level with the state of Tennessee poised to not feel a recession at all, according to the most recent information from local economists.

Larry Kessler, a research associate professor in the Haslam College of Business at the University of Tennessee at the Boyd Center for Business and Economic Research, gave city leaders an update on the state of both the national and Tennessee economies at the 2023 TML Legislative Conference. Kessler said 2022 saw a relatively volatile year with two contractions in the first part of the year and then strong growth in the second part of the year with an overall 2.1% growth for the year.

“Despite this decent second half, there are still fears of a recession, mainly for two reasons,” Kessler said. “The first is higher interest rates are leading to reduced investments. That is particularly true if you look in the real estate market. Also, higher prices are leading to reduced consumption as inflation is eroding consumers purchasing power.”

Mild contractions in gross domestic product (GDP) can lead to minor recessions, but the economic impacts of bigger issues, like the pandemic, can have larger and more far-reaching impacts. Prior to the pandemic, the country was averaging about 3% GDP growth per year. There was a 30% drop in the first quarter of 2020, but the economy recovered relatively quickly with a 35% growth rate in the third quarter of that year. This was followed by several quarters of 5-6% growth then several quarters of contractions.

“The U.S. economy recovered really quickly,” Kessler said. “Then we were back to pre-pandemic levels by the first quarter of 2021. It really only took about three quarters for the U.S. economy to get economic activity back to pre-pandemic levels. Despite a small slowdown in recent quarters, we have still seen pretty good growth since then. One of the main reasons for the quick and strong economic recovery is personal consumption spending by households on goods and services. About 70% of all economic activity in the U.S. is consumption spending. So, as long as household consumption continues and consumers continue to spend, the economy will grow at least at somewhat of a positive pace.”

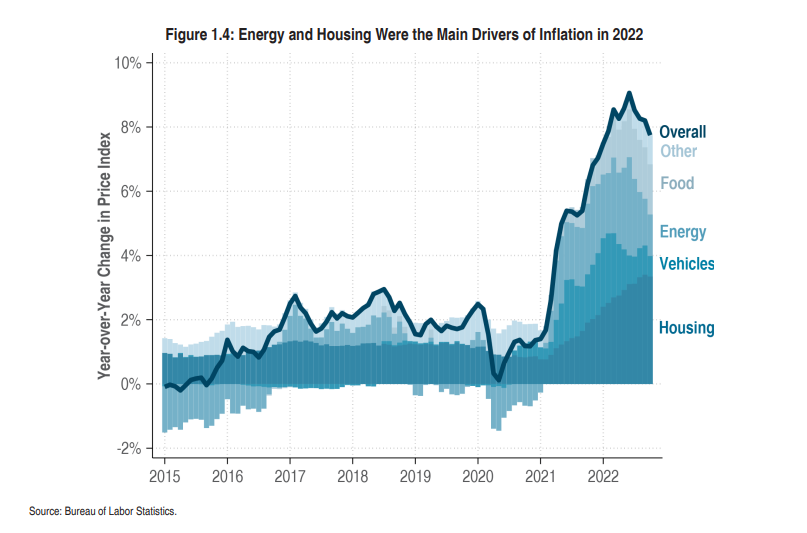

Higher prices have slowed this spending in recent quarters, though prices have come down since a peak in June 2022. As the economy opened back up following the pandemic, an increase in consumer demand was compounded by the fact that supply chain issues and business closures had created a lack of supply, which resulted in rising prices. The war in Ukraine as well as a surge in travel demand in the summer of 2022 also contributed to a spike in oil prices. Kessler said this created a “perfect storm” for inflation.

While inflation has slowed down, this has not been as quickly as the Federal Reserve would like. Kessler said the goal is between 2-3% inflation while the current rate is closer to 5-6%. Elevated housing prices are one of the reasons this rate has not yet come down, partially because housing prices take a longer time to adjust as it takes longer to replenish the supply. By increasing interest rates, the Federal Reserve hopes to stabilize the demand by encouraging consumers to save rather than spend until the supply is built back up. This is one of the reasons there is a fear of a recession.

“Higher interest rates are leading to a very sharp reduction in real estate investment,” Kessler said. “When people talk about a recession, they are talking about a recession driven by a decrease in investment, particularly in real estate investment. Following the pandemic, the Federal Reserve reduced interest rates to zero and we saw this massive spike in real estate investment. In the first quarter after the pandemic, real estate investment shot up by 77%.”

Kessler said Tennessee was able to recover from the pandemic much more quickly than the nation because the state was on better footing overall before the pandemic. The state has also seen pretty strong growth since the pandemic, not reporting any GDP contracts in 2022. Tennessee is also expected to weather a predicted recession in the national future.

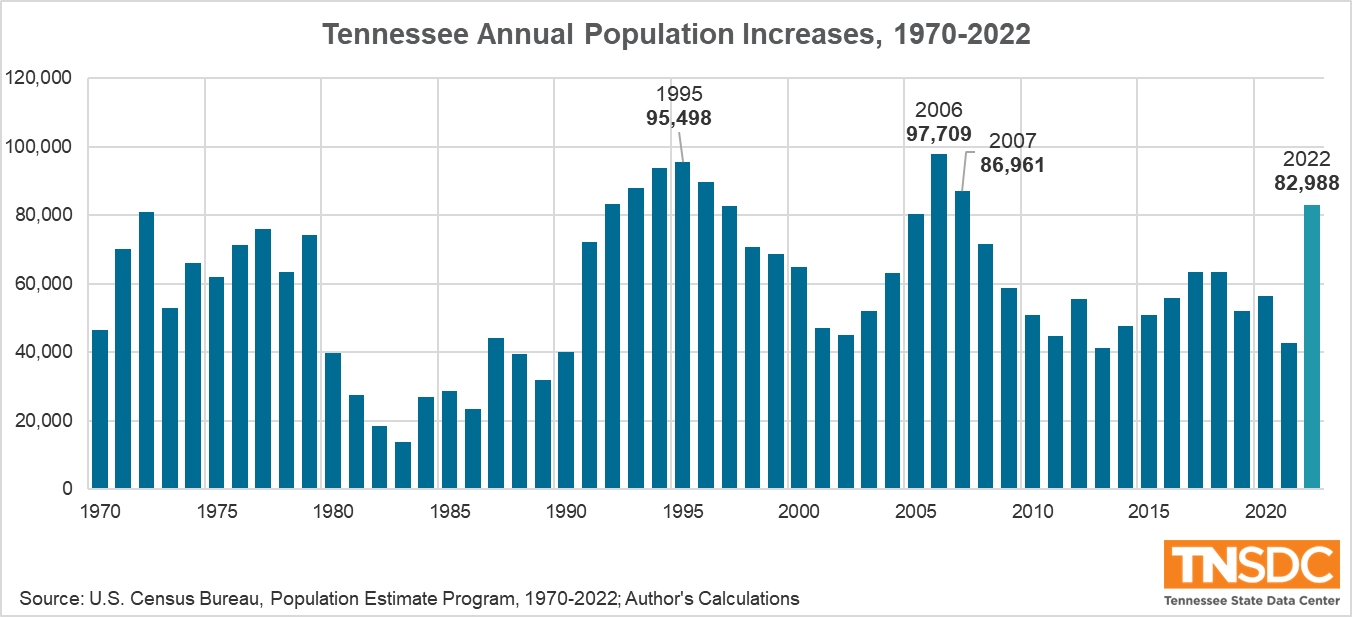

“The big reason for that is the strong rate of in-migration,” Kessler said. “That has led to a boost in economic activity, a boost in our labor market, and a boost to consumption spending across the state. Population growth in the nation and Tennessee has slowed dramatically over the past three decades... We have seen a massive spike in net-migration in Tennessee in the last year with about 90,000 new Tennesseans in 2022. That is actually the highest rate of net-migration we have seen. That means more people working in Tennessee and consuming in Tennessee, which is a boost to the economy. That is the main reason why we feel if the nation as a recession Tennessee will happen to avoid it.”

Population trends are expected to have a general impact on the national and state economy as more Americans hit retirement age and fewer new births replace the aging population. As a result, states like Tennessee that are able to attract prime workforce age residents – those between the ages of 25 and 54 – will fare better economically than the nation overall.

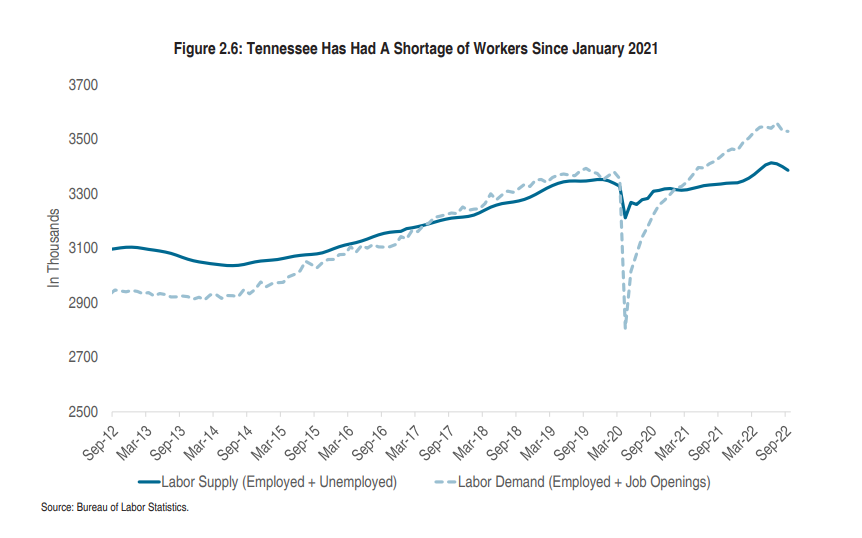

The number of workers in Tennessee has rebounded to 100,000 more workers than there were in the state pre-pandemic, but there are also more job openings than there were prior to the pandemic, meaning the state is still seeing a labor force shortage. The unemployment rate has recovered from the pandemic and remains around 3.5% as the demand for employees makes it easier for Tennesseans to find employment.

Kessler said the reason there is still a gap between unemployment numbers and labor force needs is because during the pandemic a good chunk of the labor force either retired early or previously dual-income households decided they managed better as single-income households with one parent staying home. The labor force is down by 2.2% points, a trend seen both nationally and on the state level.

Tennessee has seen a rise in franchise and excise as well as sales tax revenues as more people spend following the pandemic. A massive boost to taxes also came as changes to how online sales taxes are collected accounts for some of the jump. Adjusting for inflation, Tennessee is seeing a 2% increase in sales tax collections, which is back to pre-pandemic trend levels.