Amid slower growth, state budget requests focus on infrastructure, economic development

By KATE COIL

TT&C Assistant Editor

With economic officials expecting the state to see slight to moderate growth in the next fiscal year, budget presentations from state department heads to Gov. Bill Lee focused largely on leveraging federal programs, economic development, and infrastructure.

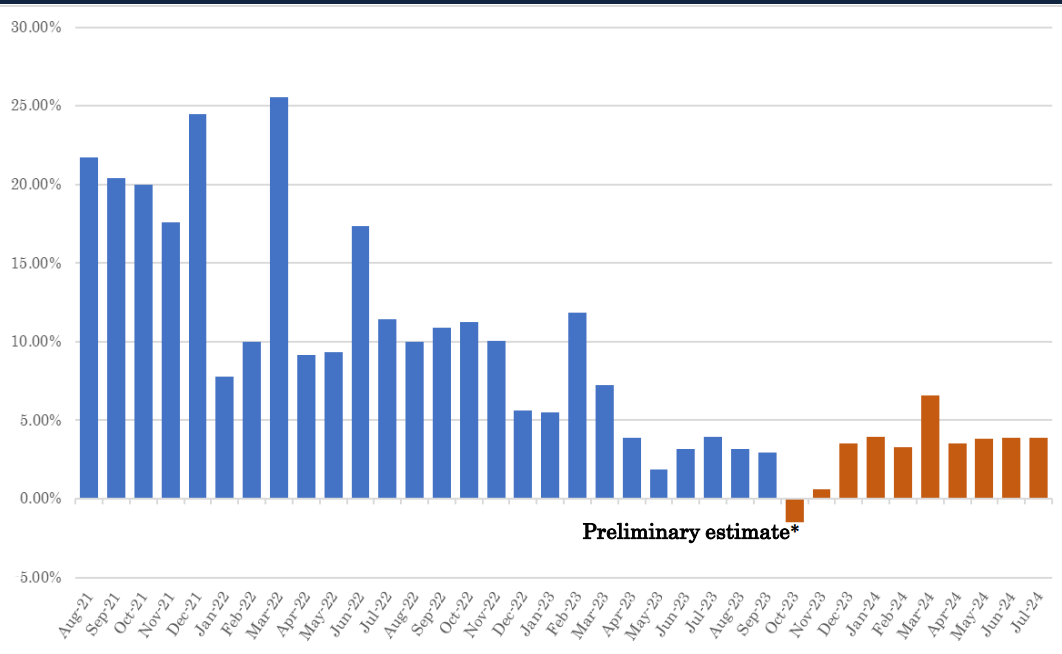

Economic experts predict that both state and national revenues will grow at a slower pace over the next two years when presenting before the Tennessee Funding Board.

While Tennessee revenue has grown from $17.4 billion to $24.7 billion in the past five years, revenue is expected to dip as COVID relief funds expire, business tax cuts such as the slowdown in franchise and excise tax collections on the state level, and the leveling off of internet sales tax collections.

Dr. Don Bruce with the University of Tennessee’s Boyd Center projected a 0.8% revenue decrease while Department of Revenue officials predicted a 0.3% decrease this year followed by a 0.4% increase next year.

The General Assembly Fiscal Review Committee projected a 1.1% revenue growth this year and 3.4% while the economic research team from ETSU proposed a more optimistic 4.8% increase this year and 4.2% the next.

TDEC

Requests from TDEC officials include:

- $13 million in non-recurring funds that will allow the department to draw down $70 million in continuing federal funding for water and wastewater projects

- $1 million state match to draw down $7.6 million to address electric grid resilience and EV infrastructure

- Investment in water reuse, such as what is being researched in Franklin

AGRICULTURE

Highlights from the Department of Agriculture presentation included:

- Record investment was made last fiscal year in emergency good assistant programs through federal programs and funding

- Agriculture and TDEC officials are working together on conservation, nutrition management, and water quality issues

- Work is being done to establish a plan for addressing issues surrounding farmland loss.

WORK FORCE DEVELOPMENT

Requests from the Department of Labor and Workforce Development include:

- Funds to allow for more up-to-date data collection to help bolster decision-making

- Adding in-house researchers for data collection

- Developing strategies to address differing labor force needs in different areas of the state

- Programs that mitigate labor force barriers such as lack of childcare, transportation, and stable and affordable housing.

TDOT

Goals and projects highlighted by TDOT officials included:

- Conducting environmental surveys earlier in the process to reduce time and cost

- Providing choice lanes on interstates, potentially as early as 2026

- Focusing on projects that can be done quickly and already have funding

- Focusing on repairing infrastructure rather than replacement

- Continuing to leverage private investment in EV fast-charging stations.

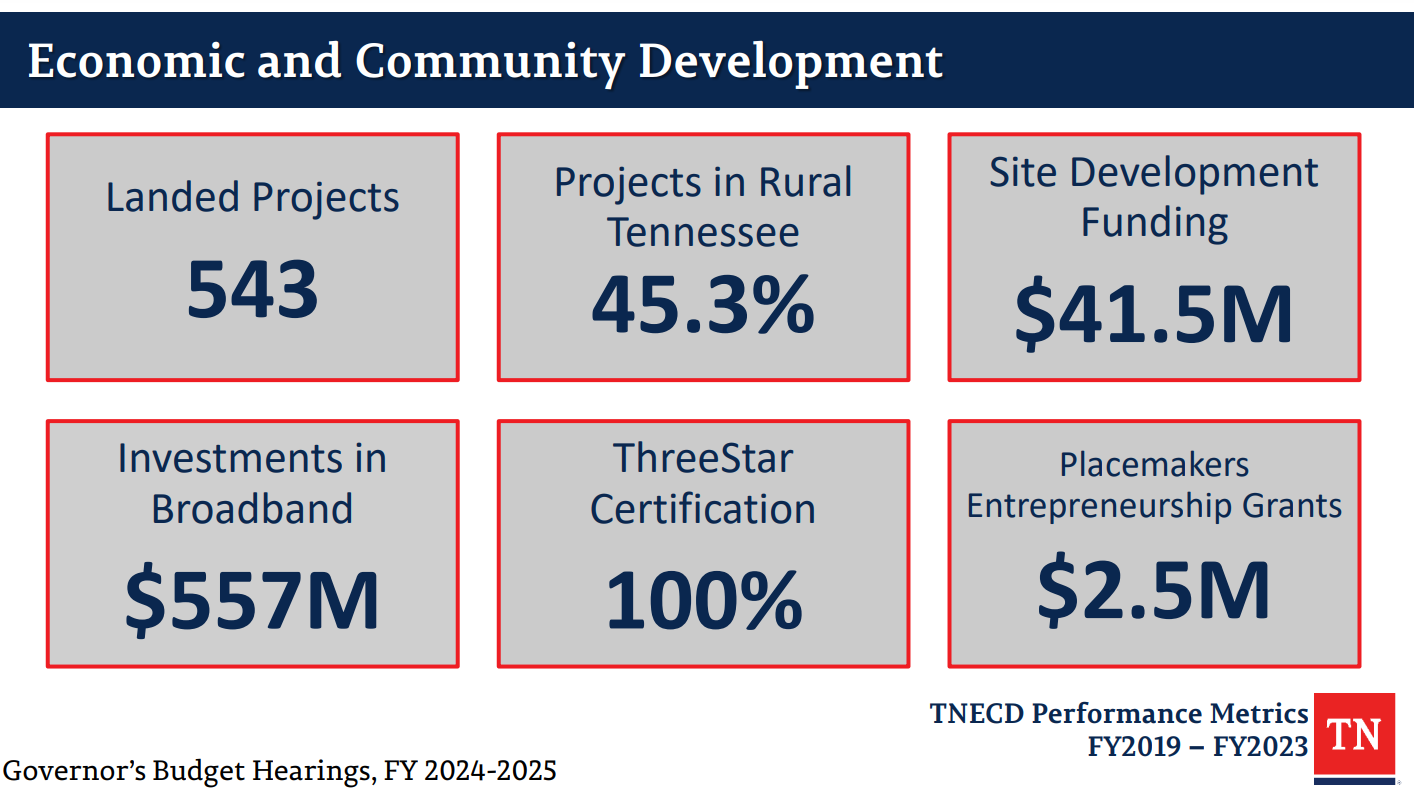

TNECD

Economic and Community Development officials said their focus for the upcoming fiscal year is on diversification of industry, elevating rural communities, small business, entrepreneurship innovation, innovations, and incentives. Requests included:

- $78 million in non-recurring funds for Fast Track incentives

- $3 million for film and music incentives

- $48 million for community infrastructure and rural economic growth strategies

- $3 million to offset technical and research costs for Launch TN

- $5 million in continued funding for TNGO

- $2.5 million for industry new hire training grant programs

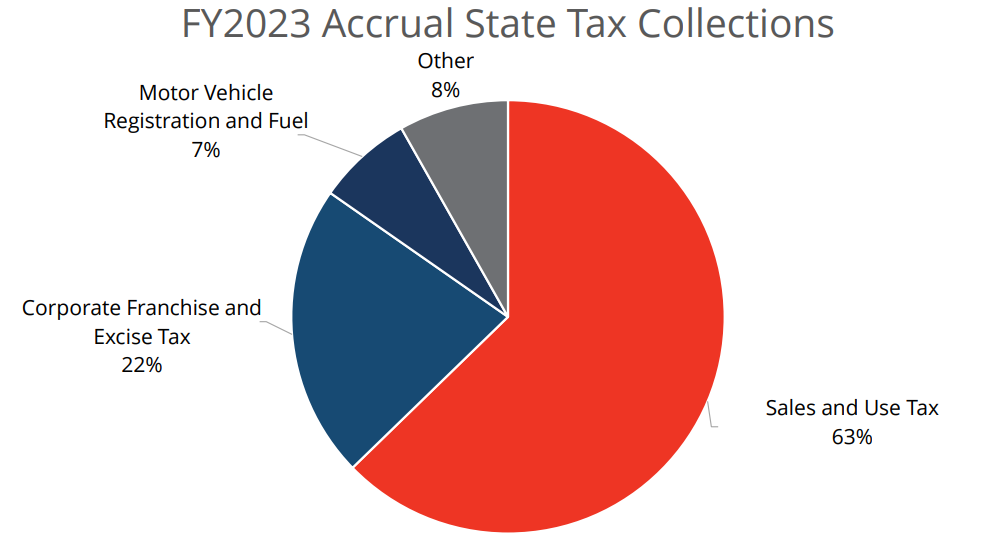

REVENUE

Revenue Department Commissioner David Gerregano noted that spending habits and buying habits in Tennessee have returned to where they were pre-pandemic.

Of particular note, Gerregano said:

- Revenue collections are leveling out to where economists expect them to be flat for the remainder of this year and into the end of the fiscal year,

- Sales tax collections are still growing

- Spending habits did not change as a result of the grocery sales tax holiday, though the final month of revenue from the holiday is yet to be reported

- Finance and excise tax collections have been down but there has been a spike in refunds. Finance and excise collections are still trending to negative growth.

MENTAL HEALTH AND SUBSTANCE ABUSE SERVICES

Commissioner Marie Williams noted that 30% of Tennesseans are struggling with some sort of mental illness and 20% are struggling with substance abuse. Many of these Tennesseans have no insurance, which means they rely on department funding as a stop gap measure.

To improve outcomes for these individuals, Williams said the department is focusing on programs like:

- Stable housing and wrap-around services for those exiting treatment and incarceration

- Providing school-based behavioral health liaisons in every county with the goal of ultimately providing every school with its own liaison

- Expanding the Children in Need Crisis Stabilization Unit piloted at Knoxville’s Helen Ross McNabb Center to four other locations in the state

- Co-locating mental health and substance abuse staff into county health departments based on a pilot program in Jackson County

- Working with judges to expand mental health and drug court programs as well as ensuring those in those programs have needed services to complete their court-mandated programs.

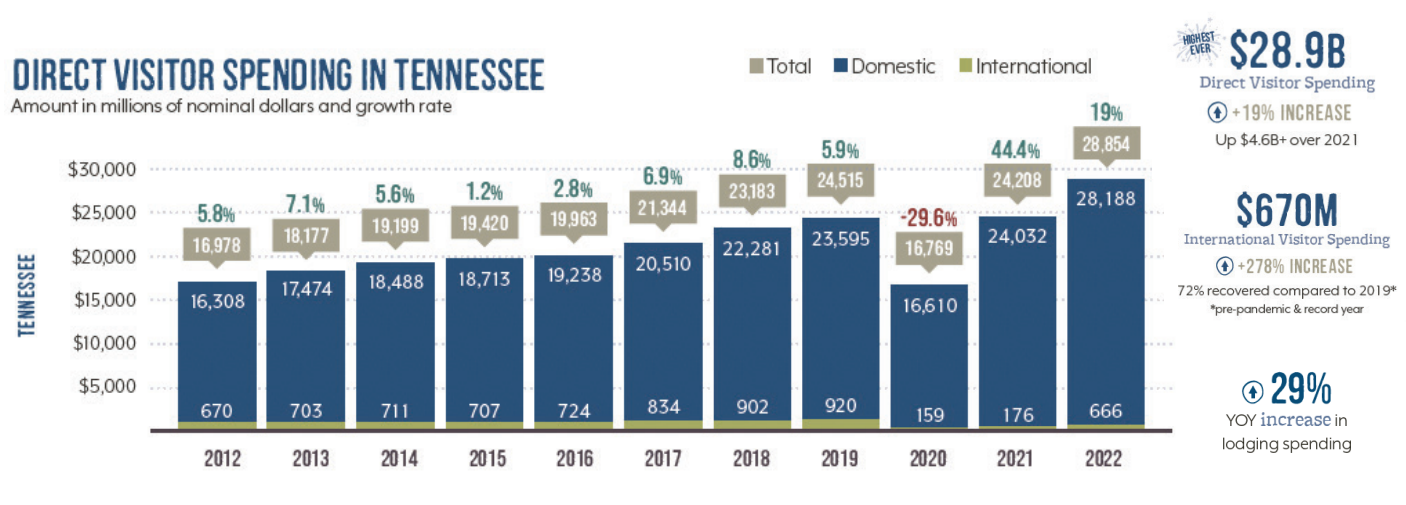

TOURIST DEVELOPMENT

Tourism Commissioner Mark Ezell touted tourist development efforts, both through educating local municipalities and governments about how to market their own assets as well as efforts to do marketing nationally and internationally. Ezell noted new occupancy taxes passed in Pikeville, LaFollette, Tazewell, Gainesboro, Livingston, and Elizabethton have added revenue streams from visitors to help local economies.

Upcoming projects for the department include:

- Continuing to provide marketing training and destination development tools for local tourism officials

- The development of BikeTN, a road cycling initiative that will traverse backroads in 40 counties

- Additional marketing campaigns in viable but undeveloped markets including Washington, D.C.; Austin; Denver; Baltimore; and Toronto

- Marketing to recover the 28% loss in travel from Western Europe that has not yet returned since the pandemic

Rewatch the budget hearing livestreams from state department.