State funding board approves lower-than-average growth rate

BY KATE COIL

TML Assistant Editor

The State Funding Board voted to set a growth rate for the state lower than average but higher than last year’s projected numbers as economic experts cited a “volatile” and “uncertain” economic future for the state and nation.

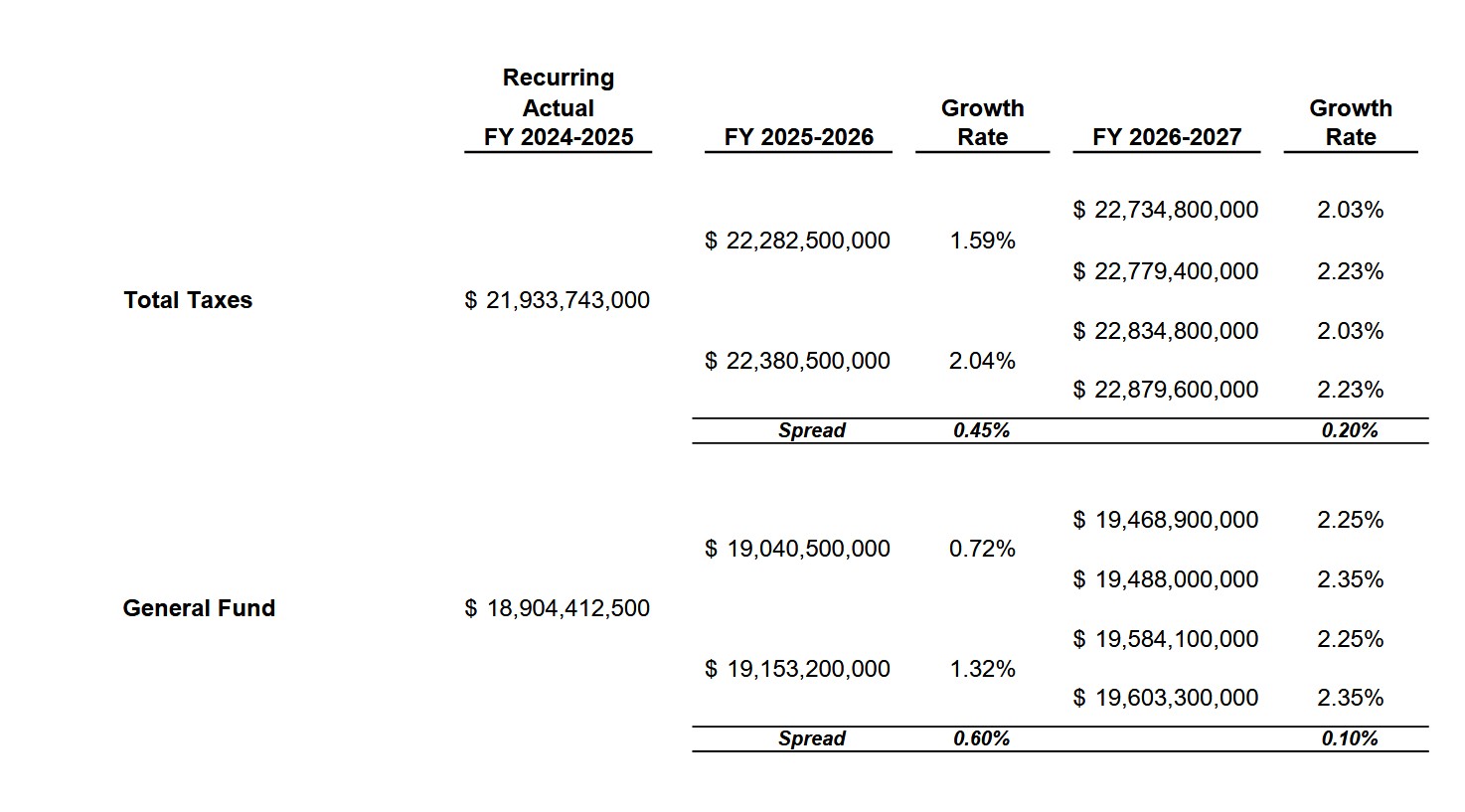

Finance and Administrator Director of Budget David Thurman said staff recommended the approval of:

- A range of 1.59% and 2.04% for total taxes in FY25-26

- A range of 0.72% to 1.32% for general fund taxes in FY25-26

- A range of 2.03% to 2.23% for total taxes in FY26-27

- A range of 2.25% to 2.35% for general fund taxes in FY26-27

The attending members of the board – Comptroller of the Treasury Jason Mumpower, Finance and Administration Commissioner Jim Bryson, and Secretary of State Tre Hargett -unanimously approved these numbers at their Nov. 24, 2025, meeting. State Treasurer David Lillard was absent from the meeting.

The projected FY25-26 budget will range from $22.28 billion on the low end to $22.38 on the high end with a general fund of between $19.04 billion on the low end to $19.15 on the high end.

Depending on the outcomes of the FY25-26 budget, projections for the FY26-27 budget could range as low as $22.73 billion to $22.879 billion on the high end, with a general fund of $19.46 billion on the low end and $19.60 billion on the high end.

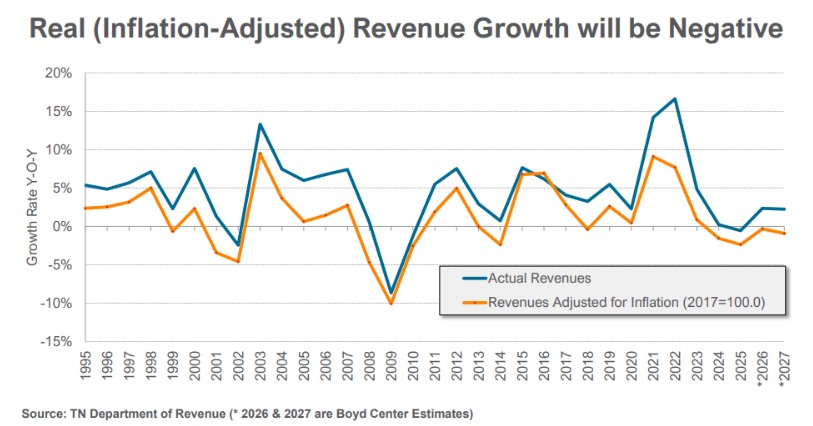

Projections by four experts ranged from 1.3% to 2.97% growth in general fund revenues in 2026, while estimates for 2027 revenue growth ranged from 2.27% to 2.5%. Many experts cautioned that inflation could wipe out this growth, even leading to a reduction in spending power.

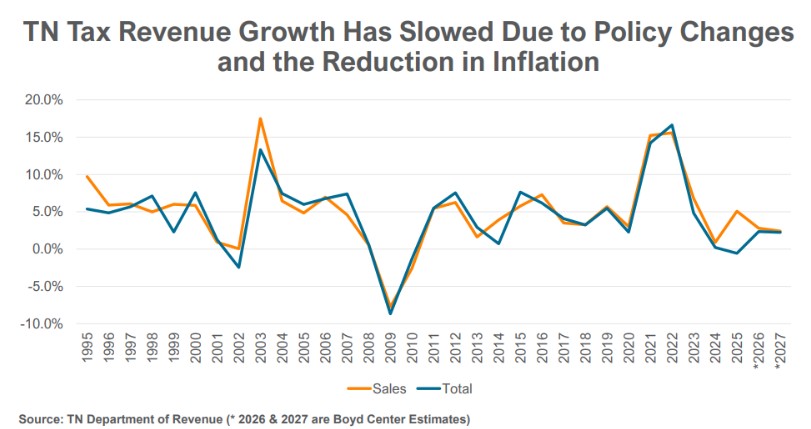

The state’s “typical” growth range is between 3-5%, though last year’s approved recommendations for both total taxes and general fund taxes were in the negatives due to the elimination of certain franchise and excise taxes.

REVENUE PROJECTIONS

Dr. Don Bruce, professor of economics and director of the UT Boyd Center for Business and Economic Research, presented the results of the center’s Economic Report to the Governor. Based on this, Bruce said the center projects a conservative 1.3% general fund growth in 2026 and 2.4% in 2027.

Bruce said volatility is the watchword when it comes to projecting next year’s tax revenues.

“The troubling aspect of this volatility is that it is multifaceted; it’s not just one thing we are paying attention to,” Bruce said. “Forecasting revenues based on historic collections is very difficult. With volatility being the key word, we are projecting positive nominal growth for total collections in FY26-27.”

The Boyd Center is also projecting 2.8% growth for sales and use taxes in 2026 and 2.4% growth in 2027 while franchise and excise taxes are projected to grow by 0.3% in 2026 and 1.2% in 2027. Bruce anticipates sales and use tax increases will be enough to offset flagging franchise and excise tax growth.

Dr. Joseph Newhard, assistant professor of economics at ETSU, predicted a stronger 2.28% growth rate in 2026 and but 2.27% in 2027.

“Tennessee is growing in terms of labor force, real output, and collections,” he said. “We are building more housing and although the trade war is harming certain sectors, the economy continues to grow. A few issues are worth keeping an eye on. Manufacturing jobs and the retail sector are down slightly, and the rising cost of living is imposing a burden on consumers.”

Newhard anticipates sales and use taxes to increase by 4.48% in 2026 and 2.96% in 2027, while franchise and excise taxes decrease by 4.73% in 2026 but grow by 0.11% in 2027. Accounting for both inflation and population growth, Newhard said nominal and real tax collections for the state have actually remained flat since the 1980s.

Tennessee Department of Revenue Director of Research Jeff Bjarke said the department expects positive overall revenue growth but slightly lower than the rate of inflation. This may mean a decrease in real terms as things the state needs to purchase become more expensive.

The department predicts a 2.8% total revenue growth in 2026 and 2.5% in 2027, with sales and use taxes projected to grow 3% in 2026 and 2.6% in 2026, while franchise and excise taxes may grow by 0.8% in 2026 and 1.2% in 2027.

Bjarke also highlighted policy-driven negative revenue growth of –0.6% in 2025. Sales and use tax typically count for about 60% of collections, but it has moved up to 67% because of changes to franchise and excise taxes. While he does expect a rebound in franchise and excise tax, it will be minimal.

State Fiscal Review Committee Executive Director Bojan Savic projected the most robust growth with 2.97% revenue growth in 2026 and 2.32% in 2027. Savic also predicted sales and use taxes to grow by 3.37% in 2026 and 3% in 2027, while he anticipated franchise and excise taxes to grow by 0.61% in 2026 but decrease by 1.33% in 2027.

ECONOMIC OUTLOOK

Bruce said the center is expecting slower national gross domestic product (GDP) growth, but for Tennessee’s GDP to continue to outpace the national rate. Additionally, Bruce said inflation remains stubbornly high and that it is an important message that inflation can no longer be relied upon to prop up revenue collections.

“Our two major revenue streams are highly dependent on price,” Bruce said. “As inflation goes so goes collections on sales taxes and franchise and excise taxes.”

A recent survey of business leaders by the Boyd Center found that more than three quarters say their business has been impacted by tariffs, with a quarter of respondents saying their business has been majorly impacted by tariffs. However, the majority (55.8%) said they are not passing tariff costs on to their customers.

Newhard said Tennessee has the third highest amount of imports of any state in the nation and is 14 in terms of exports to other countries, making tariffs of concern to the state’s economy. Imports make up 21.9% of the state’s GDP versus 11.2% for the national GDP while exports make up 7.1% of both the state and the national GDP.

While 2% has traditionally been the goal for the Fed when it comes to cutting interest rates, Newhard said he expected 3% to become the new benchmark. Newhard highlighted uncertainties and challenges such as tariff policy, the growing national debt, immigration policy, inflation and wages, interest rates, housing costs, GDP growth and AI spending, and job growth.

Bjarke said Tennessee is one of the most manufacturing-dependent states in the South, which makes it more susceptible to uncertainty from trade policies. Savic said political and policy uncertainty regarding trade, tariffs, and other federal actions, including reductions in federal funds, should be anticipated.

Additionally, Savic said that while consumer spending has grown, consumer sentiment and expectations have plummeted over the course of the year.

HOUSING

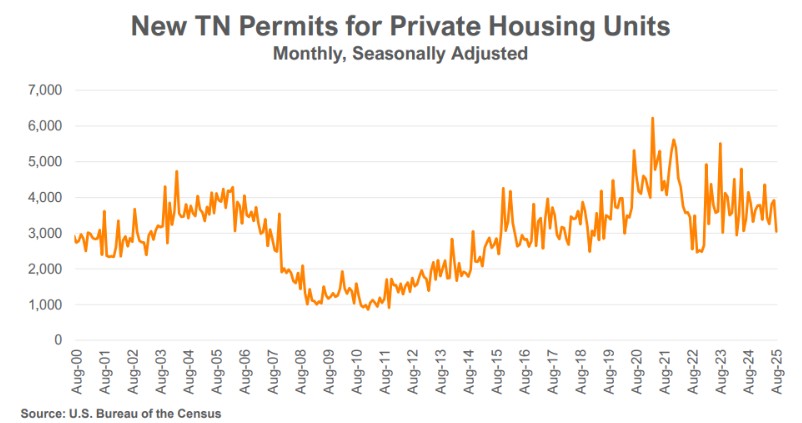

Bruce said housing price appreciation is more under control, though housing prices remain high. One positive is that more listings are on the market and are remaining on the market for longer periods of time.

“We are still recovering from that severe shortage in the post-Covid economy,” he said. “To get housing markets under control requires a supply side response. Still there are pockets of pressure in parts of the state, particularly in Middle Tennessee and the Knoxville area.”

Newhard said Tennessee has the second-highest median listing price in the southeast, following only Virginia. Tennessee ranks second highest in the ratio of median income to median housing prices in the southeast.

While two-thirds of Tennessee homes are owner-occupied, housing prices and affordability continue to be major contributors to declining birth rates. Tennessee is one of 15 states that has returned or surpassed its pre-pandemic housing supply, but there are also regions of the state recovering their stock more quickly than others. Newhard said continuing to build housing supply is key to recovery of the housing market.

Bjarke said the increase Newhard is projecting in housing permits and building is being born out in revenue projects. Bjarke noted expectations that mortgage originations both in refinancing and purchasing will increase to relatively high levels, driving privilege taxes.

LABOR MARKET

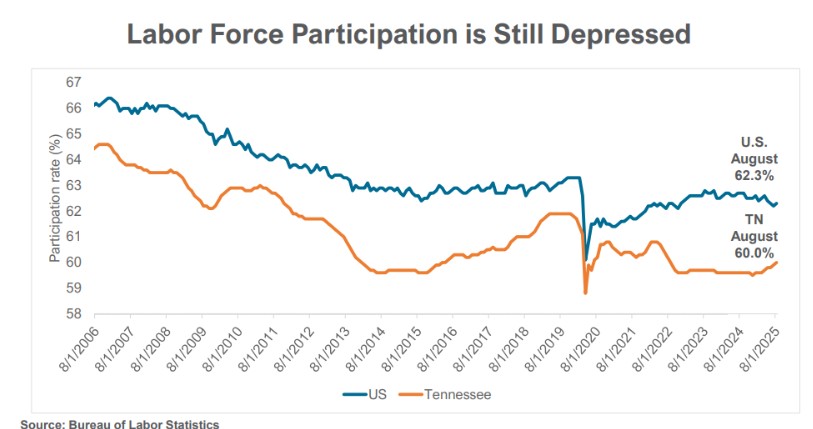

Bruce said the state has seen an uptick in labor force participation since the post-pandemic decline. While Tennessee has had lower unemployment rates than the national level, the state’s labor force participation rate has remained stubbornly below the national rebound.

Newhard said that while the state has seen job growth, manufacturing has lost 8,500 jobs or 3% of the workforce since 2022. Savic said that many companies seem to be in a “wait and see” mode, not making many new hires but also not firing employees. Workers also seem to be hanging onto their jobs for longer rather than seeking positions elsewhere. Savic said he anticipates the job growth stagnation to continue.

Incomes in the state have also been growing with Tennessee’s average income reaching $64,908. This remains slightly lower than the Southeastern average of $65,084 and the U.S. average of $72,425. However, Tennessee's cost of living remains about 10% lower than the national average.

While median household income has grown since the 1980s, Newhard said living standards have improved more modestly and rising standards of living are held back by rising costs. Additionally, Savic said the amount of personal savings Tennesseans are putting aside is declining. Bruce noted that for every $100 someone’s income increases, their spending goes up $3-5.

With deaths continuing to exceed births in the state, Bruce said labor demand is only being met through in-migration to the state. The state had a tremendous shortage of workers to meet labor demand since the pandemic, but the gap is beginning to narrow considerably. If every unemployed person in the state was put to work, Bruce said there would still be 21,000 unfilled jobs.

Newhard said population growth tends to increase where cost of living is more affordable. He expects the state’s population growth rate to stay positive but down from some of its recent highs.